“The largest stocks in the S&P 500 are a different group of companies than they were in 1996, or 2006, and yet their aggregate profitability has risen even as some former stars have seen their fortunes fade. On this front, the question is really whether the environment that has favored these dominant firms is likely to remain so biased in their favor. My guess is that it is not. The recent announcement of anti-trust investigations against the largest technology and related communications firms seems unlikely to be a one-off. Apart from the simple issue of their growing dominance and staggering profits, the negative societal and privacy impacts of their basic business models make it harder to paint them as plucky upstarts improving the world and easier for critics to characterize them as disturbing big brother entities feeding off the worst instincts of humanity. Health care companies face a similarly daunting level of unpopularity, driven by their pricing practices combined with the striking disconnect between the amount the U.S. spends on health care versus the rest of the world and the health outcomes that spending seems to deliver. The growing interest in academia and beyond in studying the deleterious effects of large firms beyond looking at the direct impact on consumer prices also suggests a broader push against dominant firms on principle is increasingly likely.”

~ Ben Inker, Head of Allocation, GMO 2Q Quarterly Letter

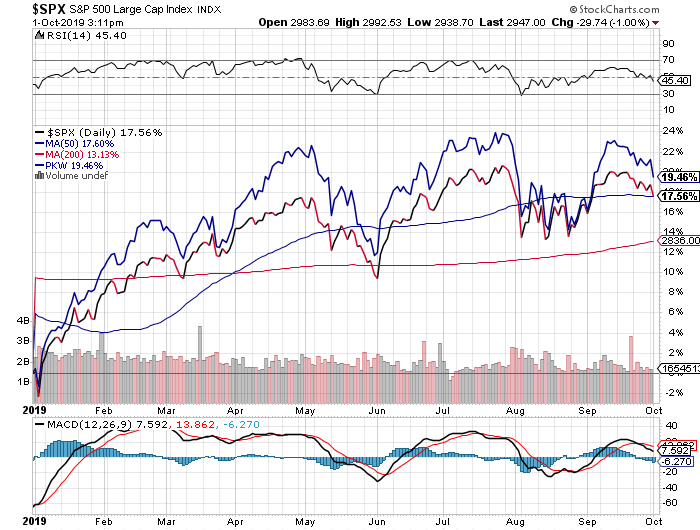

S&P 500 (SCHX)

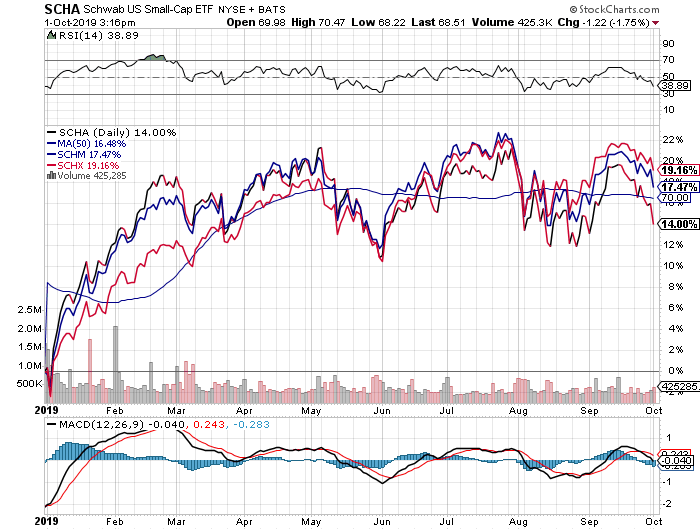

U.S. Small Caps (SCHA), U.S. Mid Caps (SCHM), U.S. Large Caps (SCHX)

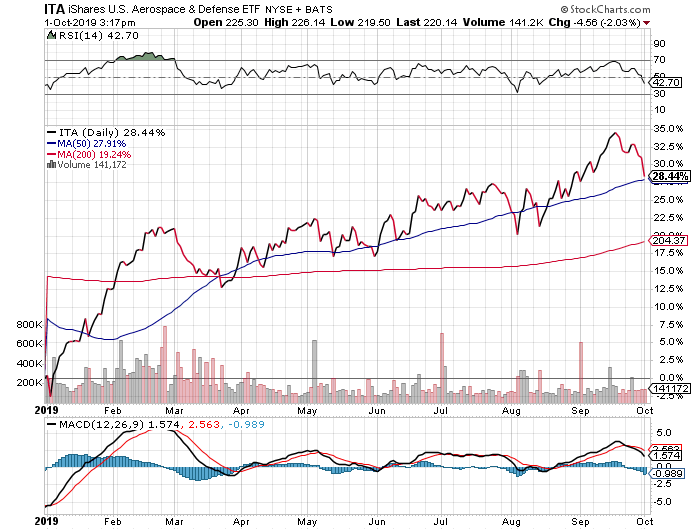

U.S. Aerospace & Defense (ITA)

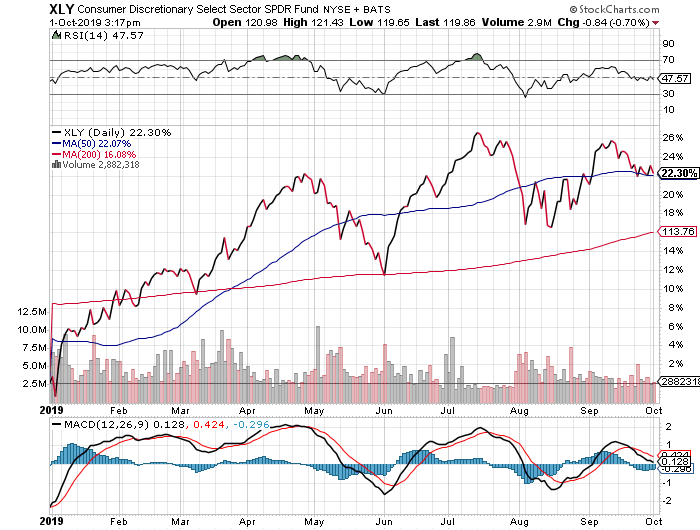

Consumer Discretionary (XLY)

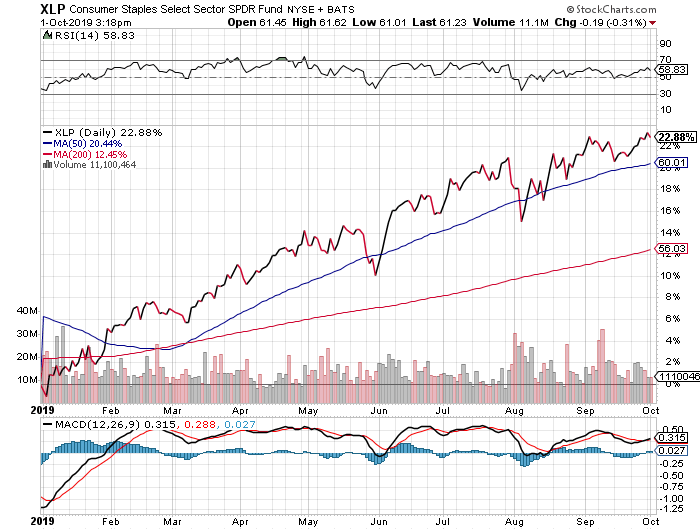

Consumer Staples (XLP)

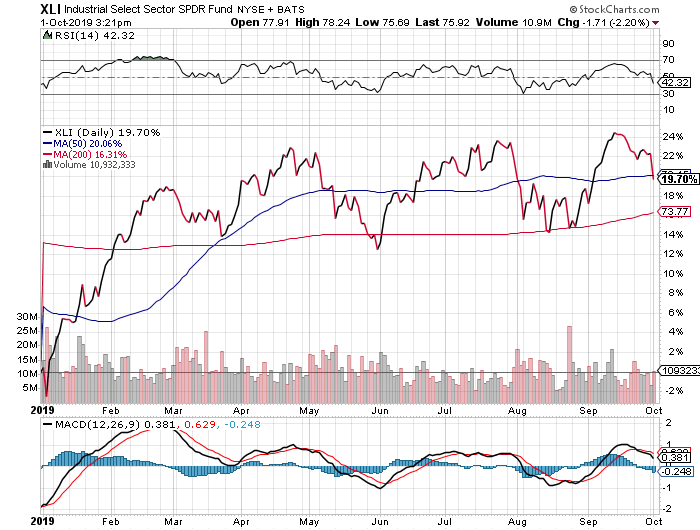

Industrial Select (XLI)

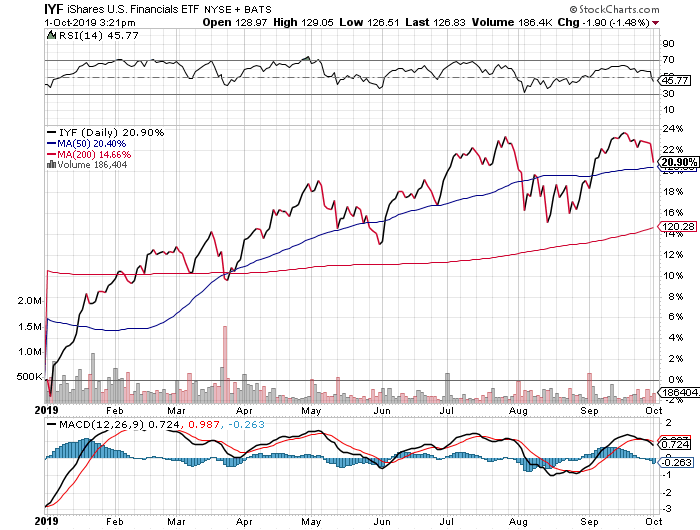

U.S. Financials ETF (IYF)

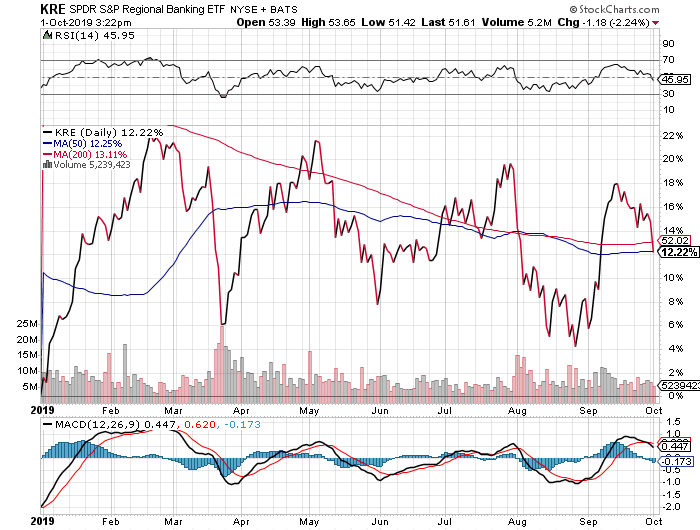

S&P Regional Banking (KRE)

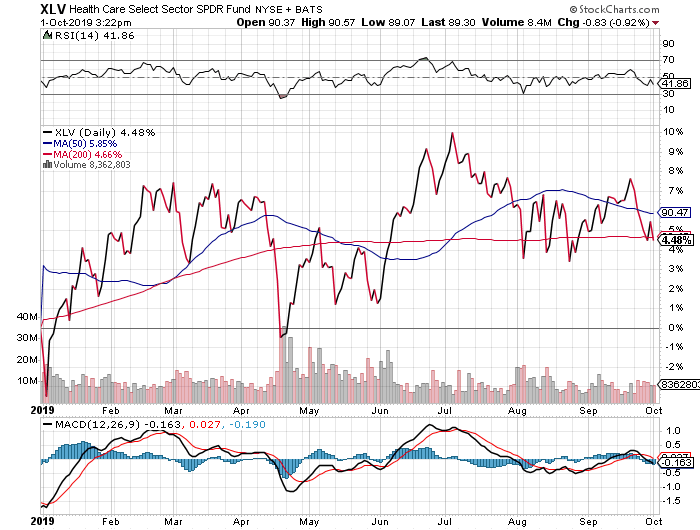

Health Care (XLV)

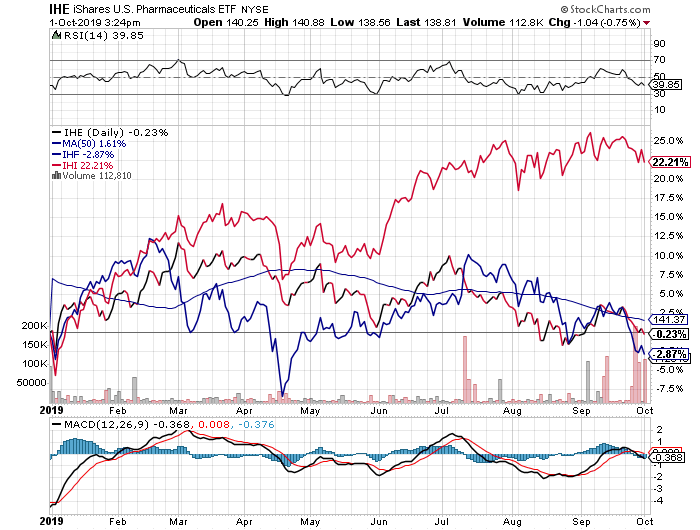

U.S. Pharmaceuticals

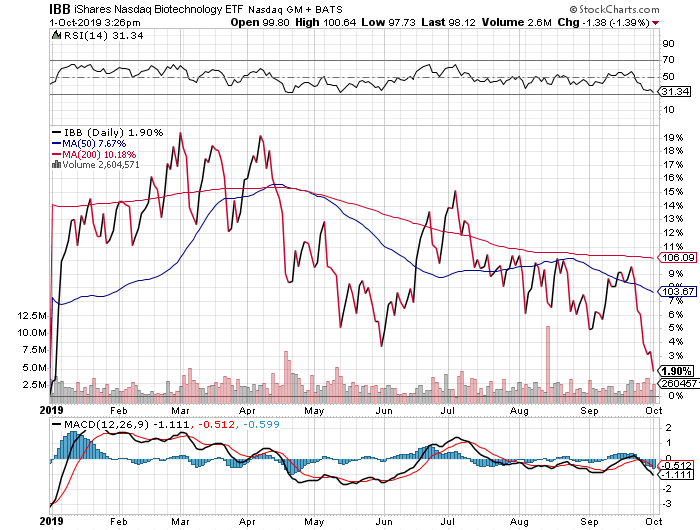

Biotech (IBB)

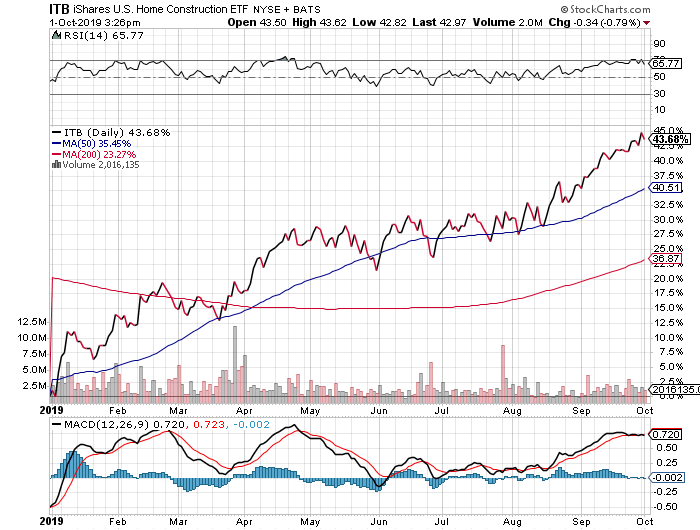

U.S. Home Construction (ITB)

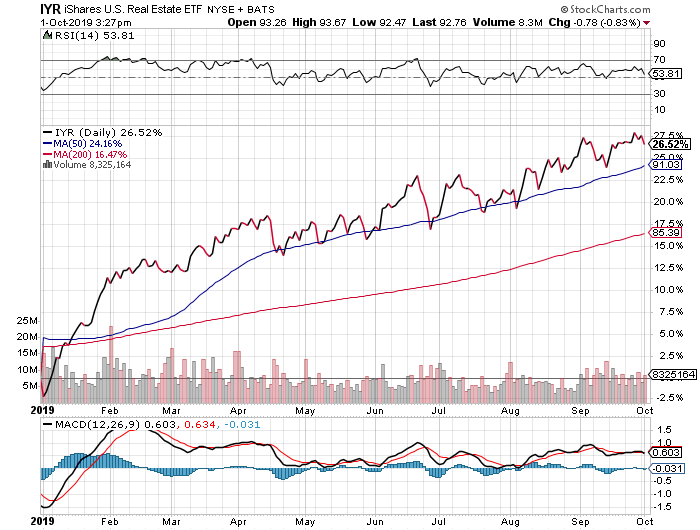

U.S. Real Estate (IYR)

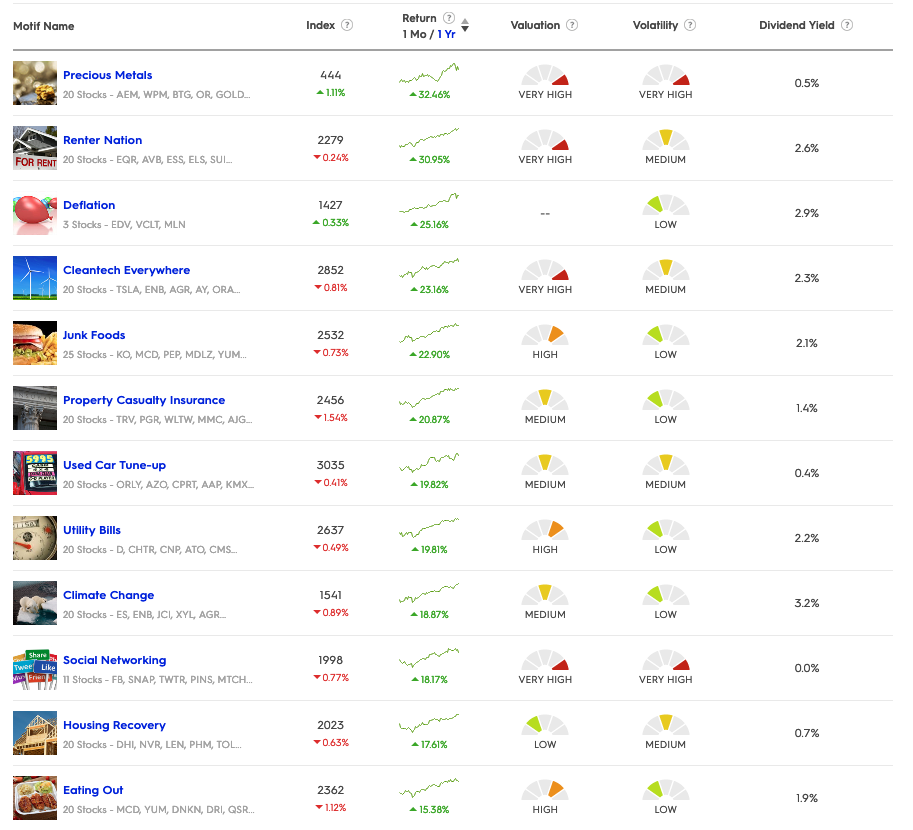

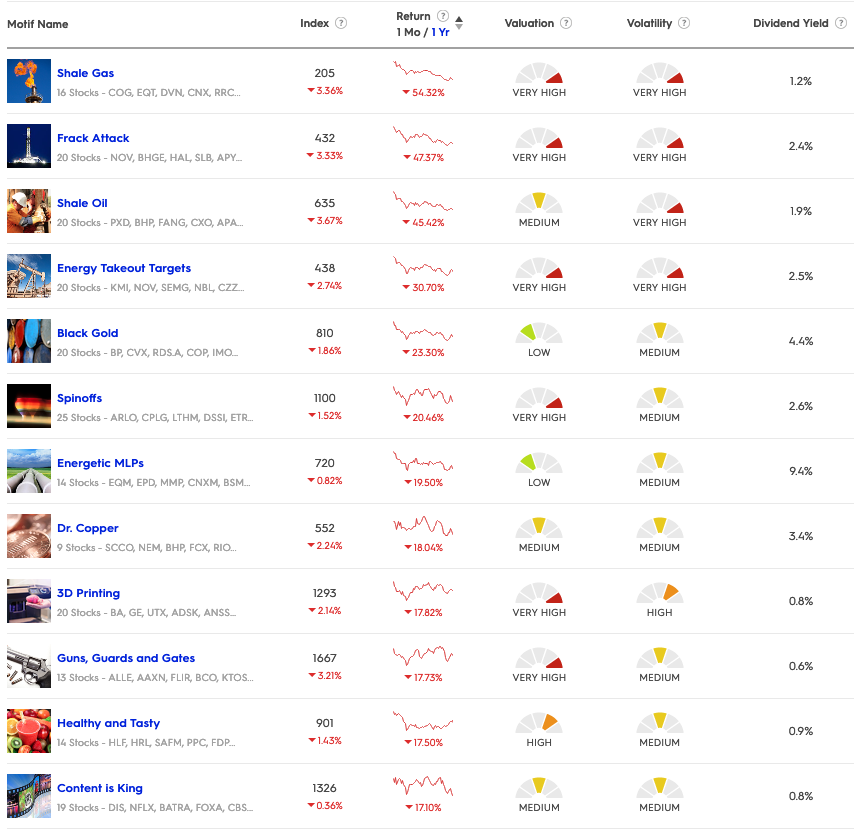

Motif Investing: Highest Earners (1-Year Returns)

Motif Investing: Lowest Earners (1-Year Returns)

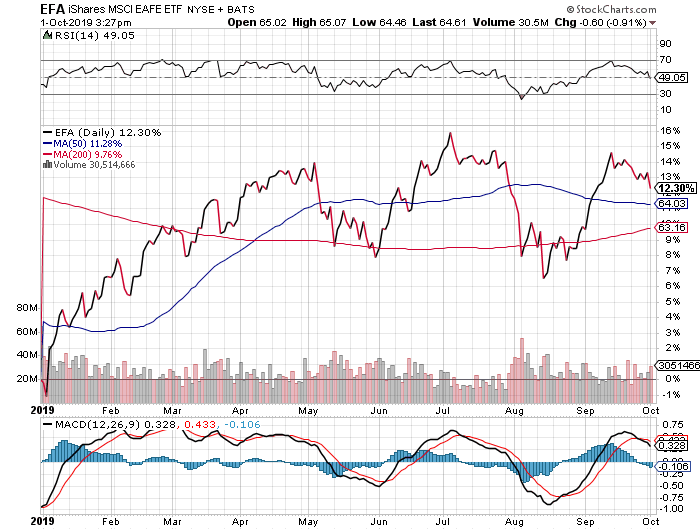

International Developed (EFA)

Europe

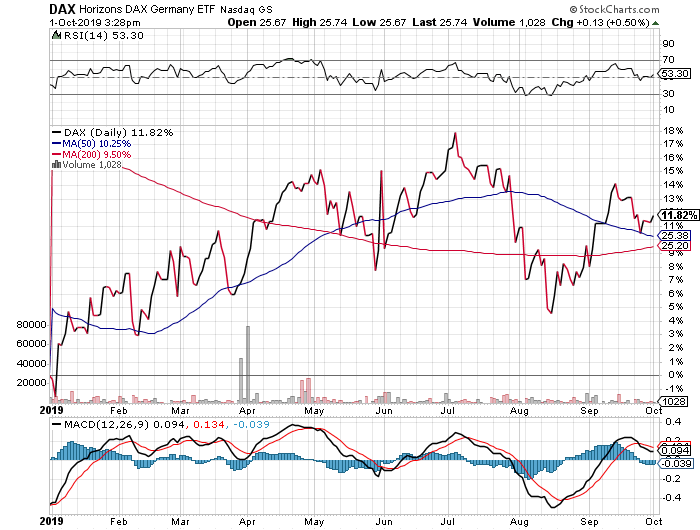

Germany (DAX)

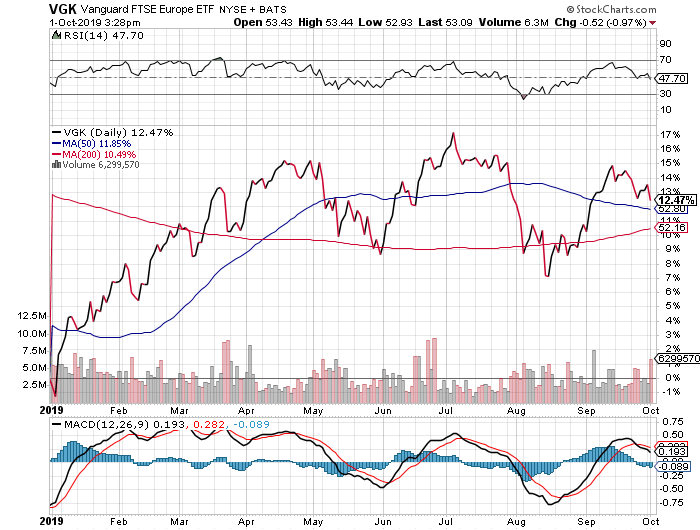

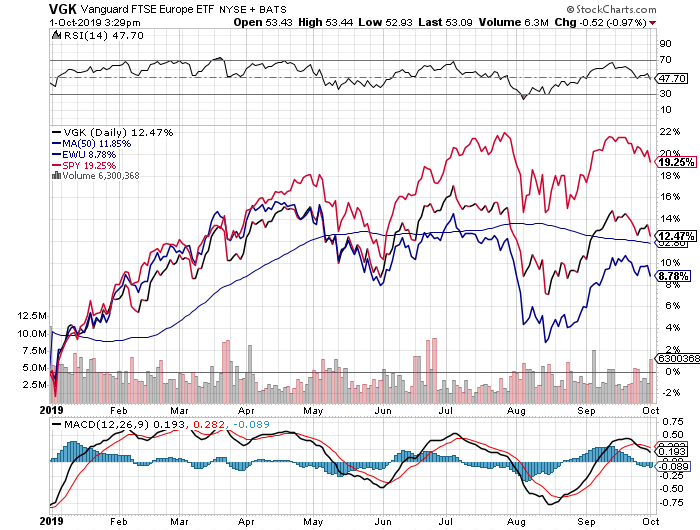

FTSE (VGK)

VGK (FTSE), EWU (UK), SPY (S&P)

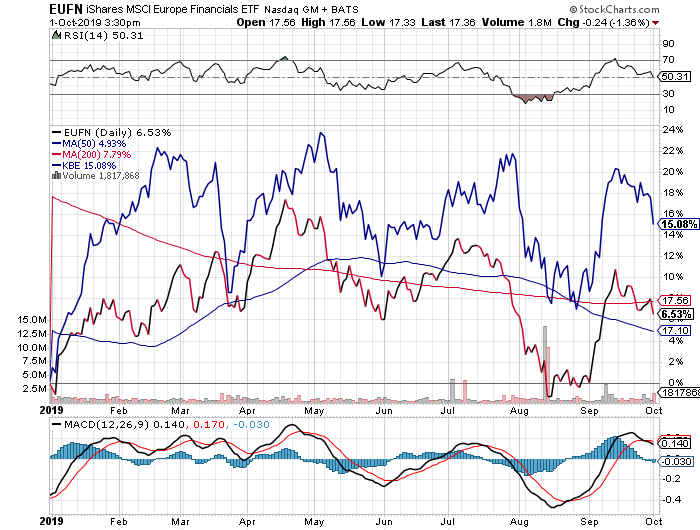

European Financials (EUFN), U.S. Financials (KBE)

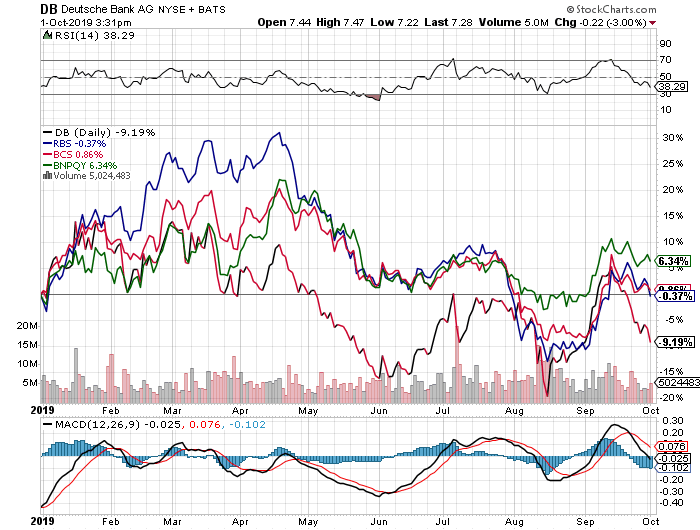

European Financials: Deutsche Bank (DB), Royal Bank of Scotland (RBS), Barclays (BCS), Paribas (BNPQY)

Asia

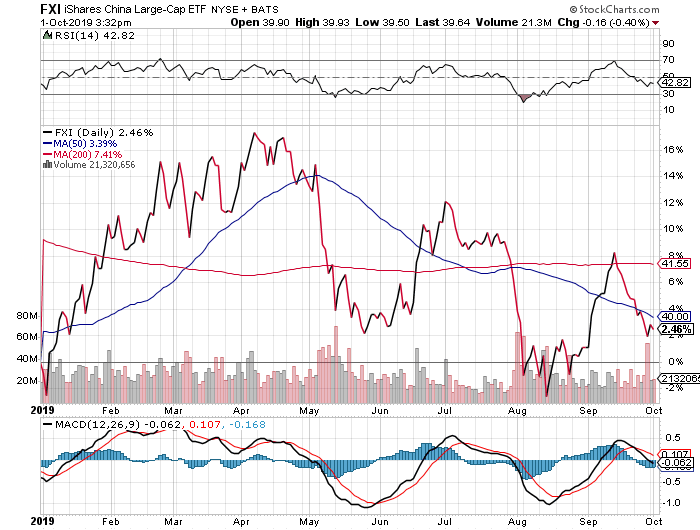

China Large Caps (FXI)

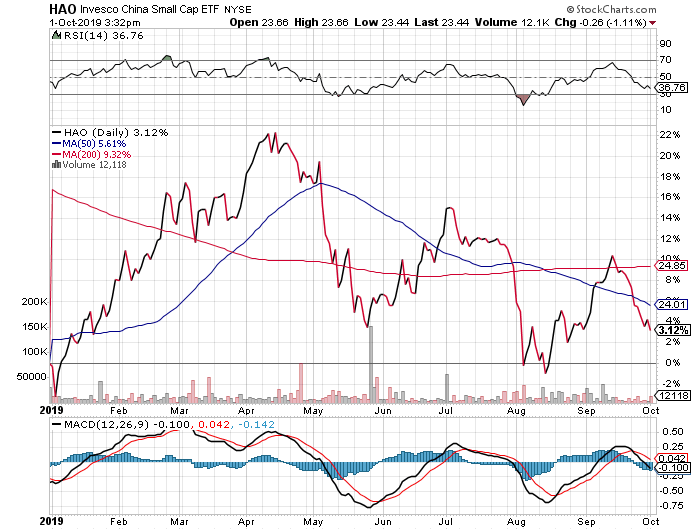

China Small Caps (HAO)

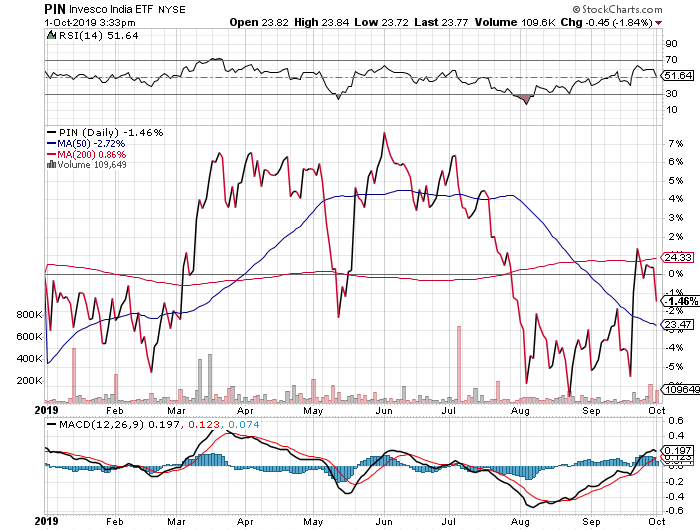

India (PIN)

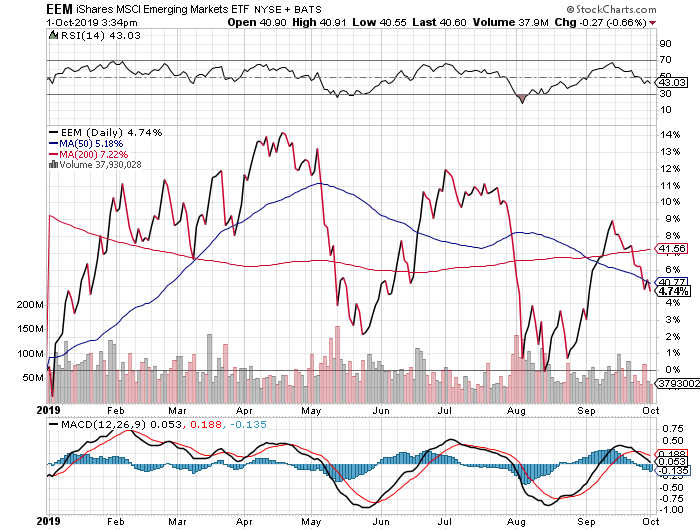

Emerging Markets

Emerging Markets (EEM)

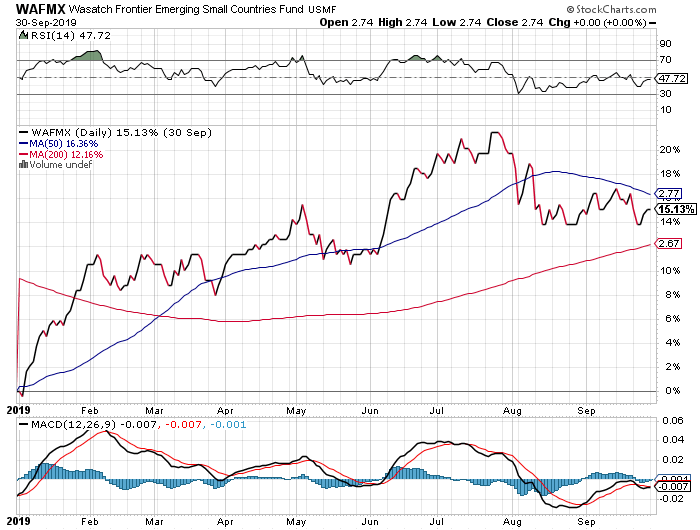

Frontier Markets (WAFMX)